Open a Chinese Yuan Business Account

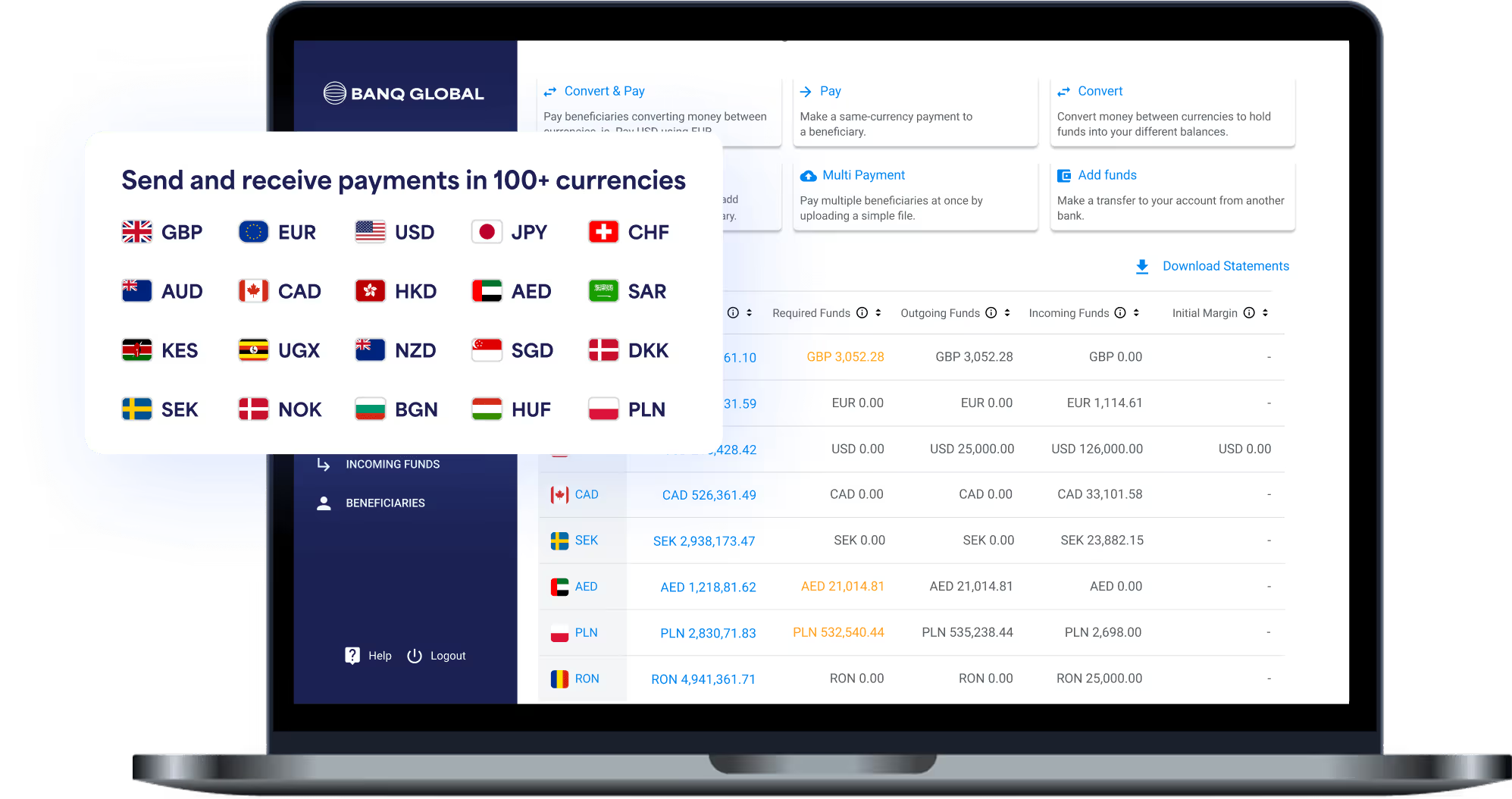

Open a CNH business account and access offshore Renminbi with confidence. Hold, send, and receive CNH via SWIFT without needing a Mainland onshore account. Manage your CNH balances with clear control over every transaction.

What’s Included with Your Chinese Yuan Business Account

A dedicated CNH currency account integrates your treasury into China’s trade ecosystem while retaining global flexibility. It avoids unnecessary conversions, reduces settlement friction, and gives finance teams the ability to manage CNH exposure on their own terms.

Key Benefits

Hold, receive, and pay CNH balances under treasury rules to reduce repeated conversions.

Global SWIFT access for offshore CNH settlement with counterparties worldwide.

Improve supplier confidence by invoicing and paying in CNH terms.

Enterprise controls across entities, with permissions, approvals, and audit trails.

The Risk of Not Having a Chinese Yuan Business Account

Operating without CNH capability leaves corporates exposed to unnecessary costs and friction. Forced USD settlement and ad-hoc conversions create unpredictability and reduce competitiveness in China-linked supply chains.

FX erosion:

Repeated, unplanned conversions compress margins.

Payment delays:

SWIFT-only routes add intermediaries, days, and fees.

Counterparty friction:

Local partners prefer CNH transfers to domestic accounts.

Compliance hurdles:

Paying taxes and payroll without a CNH account can be challenging.

Our CNH Business Accounts Are Designed for

We support a wide range of internationally minded businesses. From fast-growing companies to established global organisations managing complex operations.

Global Corporates

Centralise CNH receivables, fund suppliers and payroll, and align CNH costs with CNH revenues for cleaner margins.

Funds & Institutions

Manage capital calls and distributions in CNH with role-based approvals and clear audit trails.

Private Equity

Efficient CNH flows for deals, fees, and SPV/holdco structures with policy-driven FX.

Family Offices

Discreet CNH management for assets, commitments, and inter-entity transfers under tight permissions.

Banq Global vs. Traditional Providers

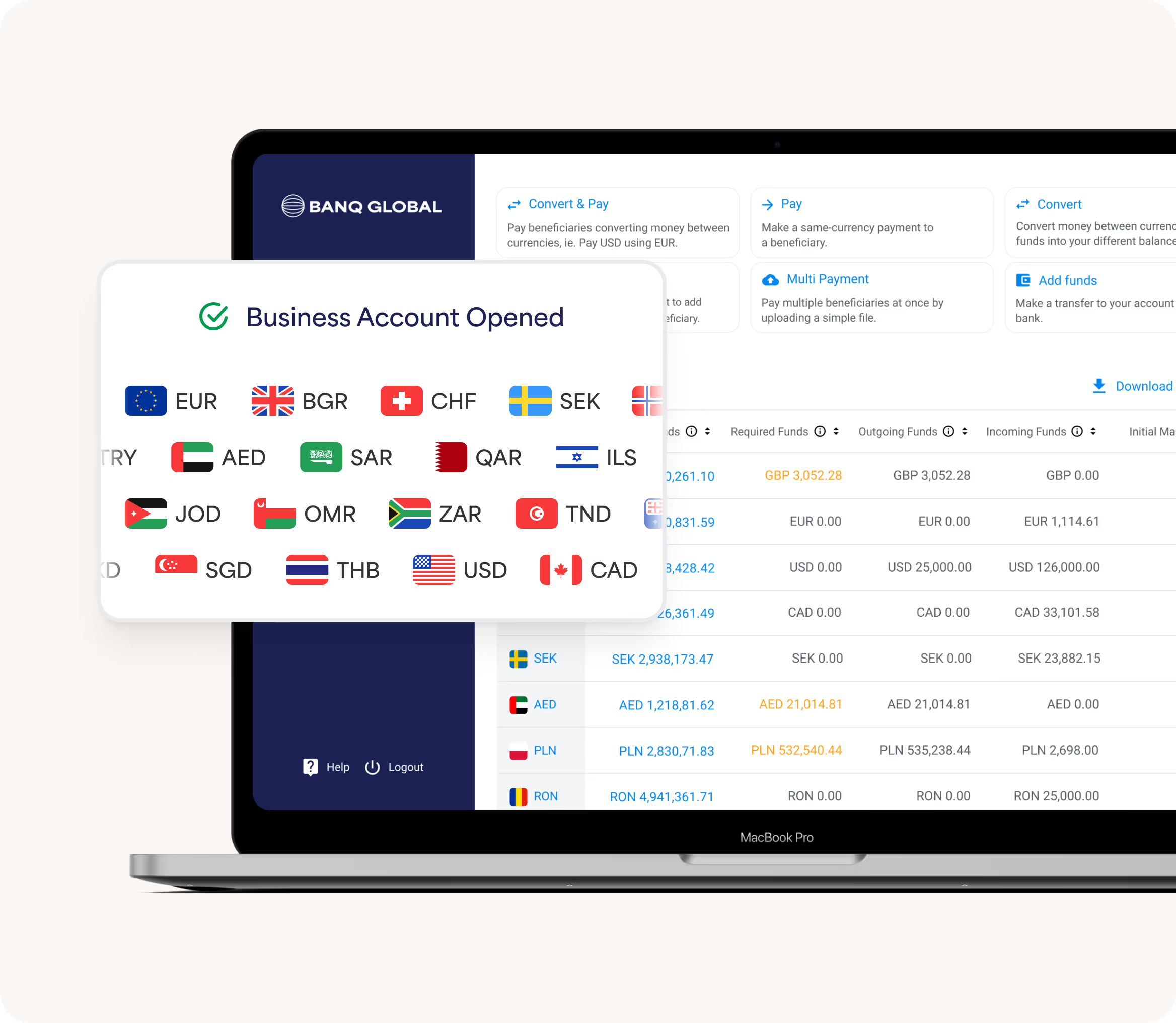

How to Open a Chinese Yuan Business Account

A clear, expert-led process that reduces rework, shortens decision time, and maintains certainty.

Scoping & Fit

We review your structure, directors, UBOs, and CNH flows to confirm feasibility and align the account with your treasury needs.

Document Pack

A precise, tailored checklist for your entity type and structure, minimising rounds of clarification.

Compliance Review

Disciplined AML/KYC due diligence with prompt Q&A and clear status visibility.

Account Issuance

CNH account in your company’s name with unique IBAN and BIC.

Go-Live & Controls

Users, roles, approvals, payment templates, and FX policy (including market orders) configured to your standards.

Chinese Yuan Business Account - FAQs

Opening a CNH account raises questions on eligibility, payment rails, non-resident onboarding, and compliance. Below are answers to the questions global finance teams ask most often.

What is the difference between CNY and CNH?

CNY refers to the onshore Renminbi, used exclusively within Mainland China and cleared through CNAPS. CNH is the offshore deliverable Renminbi, traded and settled internationally (primarily from Hong Kong, Singapore, and London). Banq Global supports CNH currency accounts, giving you offshore RMB capability without requiring a Mainland presence.

Do we need a Chinese entity or local office in China?

No. Accounts can be opened without a local presence in China. We support non-resident directors and layered UBO structures with specialist KYC handling.

Will the account be opened under our company name with unique account details?

Yes, you receive a CNH account in your company's name with a unique IBAN and BIC.

What payment rails are supported?

CNH payments are supported via SWIFT for secure international transfers.

Can we hold CNH balances long term?

Yes. You can hold CNH balances and convert them at a time that suits your needs.

Can we manage multiple entities and approvals in one place?

Yes, you can administer access per entity, set role-based approvals, implement payment approval workflows, and maintain complete audit trails.

Do you accommodate layered ownership (holding companies, SPVs, trusts)?

Yes, we regularly onboard clients with layered ownership structures such as holding companies, SPVs, and trusts, including cross-border arrangements.