Open a Canadian Dollar Business Account

Open a CAD business account and operate across Canada with confidence. Get local Canadian account details with access to EFT and SWIFT. Send, receive, and hold CAD with clear control over every transaction.

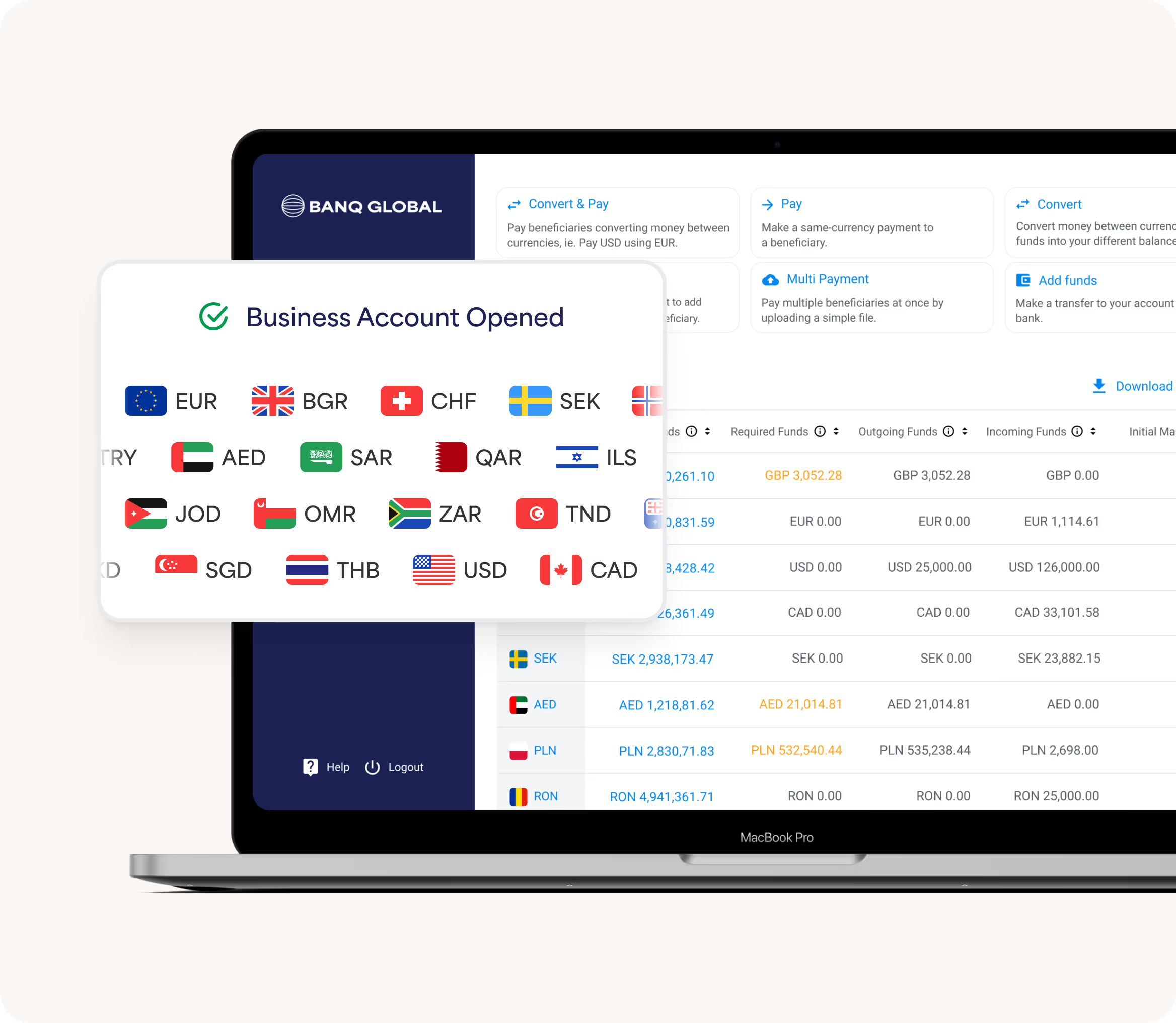

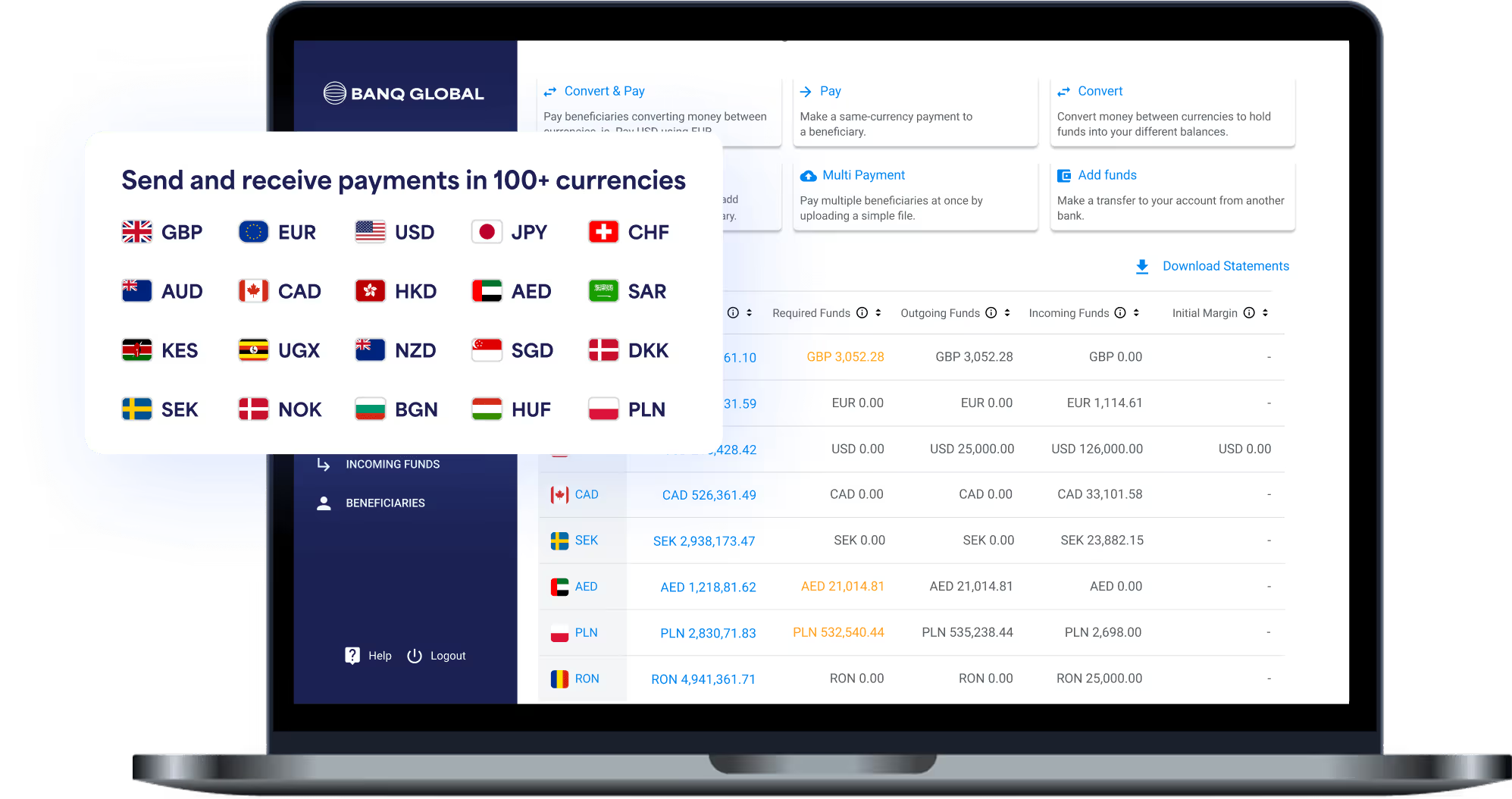

What’s Included with

Your Canadian Dollar Business Account

A dedicated CAD account embeds your operations into Canada’s domestic rails, reduces friction with Canadian counterparties, and puts FX timing under treasury policy rather than circumstance.

Key Benefits

Account in your company’s name with Canadian institution number, transit (branch) number, and account number.

Domestic rails enabled: Low-cost same-day or next-day EFT transfers.

International reach via SWIFT for cross-border CAD payments.

Treasury tools to receive, hold, convert, and send CAD under clear policy and audit.

The Risk of Not Having a Canadian Dollar Business Account

Operating in CAD without a dedicated account exposes your business to unnecessary costs, friction, and credibility gaps with Canadian partners.

FX erosion:

Repeated, unplanned conversions compress margins.

Payment delays:

SWIFT-only routes add intermediaries, days, and fees.

Counterparty friction:

Local partners prefer CAD transfers to domestic accounts.

Compliance challenges:

Paying taxes and payroll without a CAD account can be impractical.

Our CAD Business Accounts Are Designed for

We support a wide range of internationally minded businesses. From fast-growing companies expanding into Canada to established global organisations managing complex operations.

Global Corporates

Centralise CAD receivables, fund suppliers and payroll, and align CAD costs with CAD revenues for cleaner margins.

Funds & Institutions

Manage capital calls and distributions in CAD with role-based approvals and clear audit trails.

Private Equity

Efficient CAD flows for deals, fees, and SPV/holdco structures with policy-driven FX.

Family Offices

Discreet CAD management for assets, commitments, and inter-entity transfers under tight permissions.

Banq Global vs. Traditional Providers

How to Open a Canadian Dollar Business Account

A clear, expert-led process that reduces rework, shortens decision time, and maintains certainty.

Scoping & Fit

We review your structure, directors, UBOs, and CAD flows to confirm feasibility and align the account with your treasury needs.

Document Pack

A precise, tailored checklist for your entity type and structure, minimising rounds of clarification.

Compliance Review

Disciplined AML/KYC due diligence with prompt Q&A and clear status visibility.

Account Issuance

Your CAD account is opened in your company’s name with Canadian institution, transit, and account numbers, and SWIFT enablement.

Go-Live & Controls

Users, roles, approvals, payment templates, and FX policy (including market orders) configured to your standards.

Canadian Dollar Business Account - FAQs

Opening a CAD account raises questions on eligibility, payment rails, non-resident onboarding, and compliance. Below are answers to the questions global finance teams ask most often.

Do we need a Canadian entity or local office?

No. We support non-resident directors and foreign-incorporated entities, subject to KYC, UBO, and activity screening.

Will we receive local Canadian account details rather than an IBAN?

Yes. Canada does not use IBAN. You receive an institution number, transit (branch) number, and account number in your company’s name.

How long does it take to open an CAD account?

Traditional banks may take weeks to months. Banq Global’s streamlined onboarding process typically takes days, depending on entity complexity.

Which CAD payment rails are supported?

EFT transfers are supported for low-value domestics transfers. SWIFT is used for international CAD flows.

Can we send and receive CAD over SEPA?

No. SEPA is limited to euro payments. International CAD transfers always route via SWIFT.

How does holding CAD help with FX costs?

Maintaining BGN balances allows you to avoid repeated conversions, match costs with revenues, and time FX strategically under treasury policy.

Can we manage multiple entities and approvals in one place?

Yes, you can administer access per entity, set role-based approvals, implement payment approval workflows, and maintain complete audit trails.